A Clear View of Where the Marbella Property Market Stands Today

Marbella is finishing 2025 in a very strong position. Demand is high, supply is limited, and the area continues to attract both new residents and international investors. This report gives a full and honest breakdown of the market using the latest available data and our own experience on the ground.

Population and Demand

Marbella’s official population reached 166,999 residents at the end of 2024. Almost 33% of these residents are foreign and represent more than 150 nationalities. There are an estimated additional 75,000–100,000 people who spend part of the year here without being registered. Marbella’s real population therefore sits comfortably above 250,000 for most of the year.

Tourism across Spain continues to grow. There were 94 million international visitors in 2024 and more than 52 million by June 2025. Full year totals are expected to reach around 100 million visitors which directly supports the Costa del Sol. Hotel occupancy and profitability in Marbella reached new highs in 2024 and 2025 and the town now has 89 hotels operating during the summer season. This is an increase of 20 compared with the previous year which confirms the strength of travel demand.

Malaga Airport

Malaga Airport has become one of the strongest hubs in the Mediterranean. In 2024 it handled 24.9 million passengers and operated 155 direct destinations. The first half of 2025 reached 11.5 million passengers which places the airport close to its estimated capacity of 30 million passengers per year. Private aviation is also expanding with up to 60 private flights per day during the summer.

A major airport expansion has been confirmed and will take place between 2027 and 2031, almost doubling the size of the airport. The first electric air taxi route between Malaga Airport and Marbella is also planned, aiming to cut journey time to around 15–20 minutes by 2030. This level of infrastructure investment reinforces long term confidence in the region.

Sales Volumes in the Golden Triangle

The Golden Triangle performed well in 2024 with 8,708 total property sales. The breakdown is:

- Marbella: 4,745

- Estepona: 3,162

- Benahavis: 801

This represents a 5.65% increase compared with 2023 and a 31.4% increase compared with 2019.

The first half of 2025 remained stable. There were 4,293 sales which is almost identical to the 4,232 recorded in the same period in 2024. This shows that the market has stabilised at a high level after the unusually active post-pandemic period. Month to month changes remain small which reflects a mature and confident market rather than a cooling one.

New Build Supply

Spain delivered 61,457 new homes in 2024 which represented only 8.8% of national property sales. In 2005 the country produced more than 300,000 units. This highlights the structural shortage of new supply affecting the entire coast.

In the Golden Triangle only 13.6% of all sales in 2024 were new builds. Marbella itself recorded only 7.9% new build sales. Land availability is low, planning is slow, and good quality modern stock is limited. This is one of the strongest reasons prices continue to rise.

Real Achieved Prices

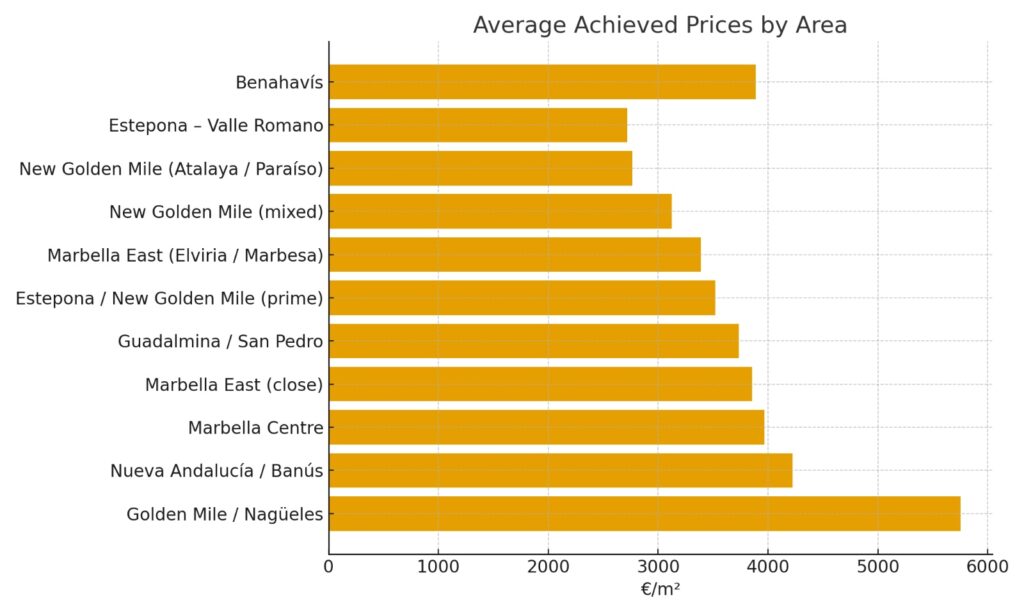

Notarial data provides the clearest picture of actual achieved sale prices.

The average achieved price in Marbella across the last 18 months is €4,228/m². Marbella recorded annual price growth of 12.6% in 2024. Asking prices listed on property portals sit around €5,400/m², showing the typical gap between asking and achieved figures.

Prices by Area

- Golden Mile / Nagüeles: €5,753/m²

- Nueva Andalucía / Puerto Banús: €4,225/m²

- Marbella centre: €3,967/m²

- Marbella East (closer zones): €3,857/m²

- Elviria / Marbesa side: €3,388/m²

- Guadalmina / San Pedro: €3,734/m²

- Estepona / New Golden Mile (prime): €3,520/m²

- New Golden Mile (mixed): €3,122/m²

- New Golden Mile (Atalaya / Paraíso): €2,765/m²

- Estepona – Valle Romano: €2,719/m²

- Benahavis: €3,889/m²

Market Benchmarks

Resale apartments in East Marbella frontline beach buildings have achieved €17,000–€20,000/m² for high quality renovated units. Golden Mile penthouses in Monte Paraíso and Benalús achieve above €14,000/m². Good original condition Golden Mile apartments sit between €5,500–€6,000/m².

Townhouses on the Golden Mile vary depending on position and condition. Arco Iris achieved €7,295/m² for a renovated unit. Marbellamar achieved €11,031/m² for a fully renovated beachside unit.

Villa benchmarks remain strong. A semi-detached villa in Vilas 6 achieved €12,634/m². A large villa in Los Arqueros achieved more than €10,500/m². Villas in La Zagaleta and Los Almendros regularly fall between €7,900–€12,600/m² depending on position, quality, and views.

Puente Romano

Puente Romano remains the strongest micro market on the coast.

- Renovated apartments average: €24,020/m²

- Apartments requiring renovation average: €19,039/m²

- Record frontline sale: €44,000/m²

This continues to position Puente Romano as one of the most valuable residential locations in Europe.

New Developments

Branded developments on the Golden Mile range from €16,000–€21,000/m². Frontline beach new builds in Estepona exceed €15,000/m². High end schemes in Finca Cortesin and Benahavis range from €7,000–€10,000/m². Standard modern developments fall between €3,000–€7,000/m². Branded aparthotel concepts such as Nikki Living sit around €10,000/m².

Less than 10% of buyers above €2,000,000 use financing. The luxury market is driven primarily by cash.

Buyer Profile

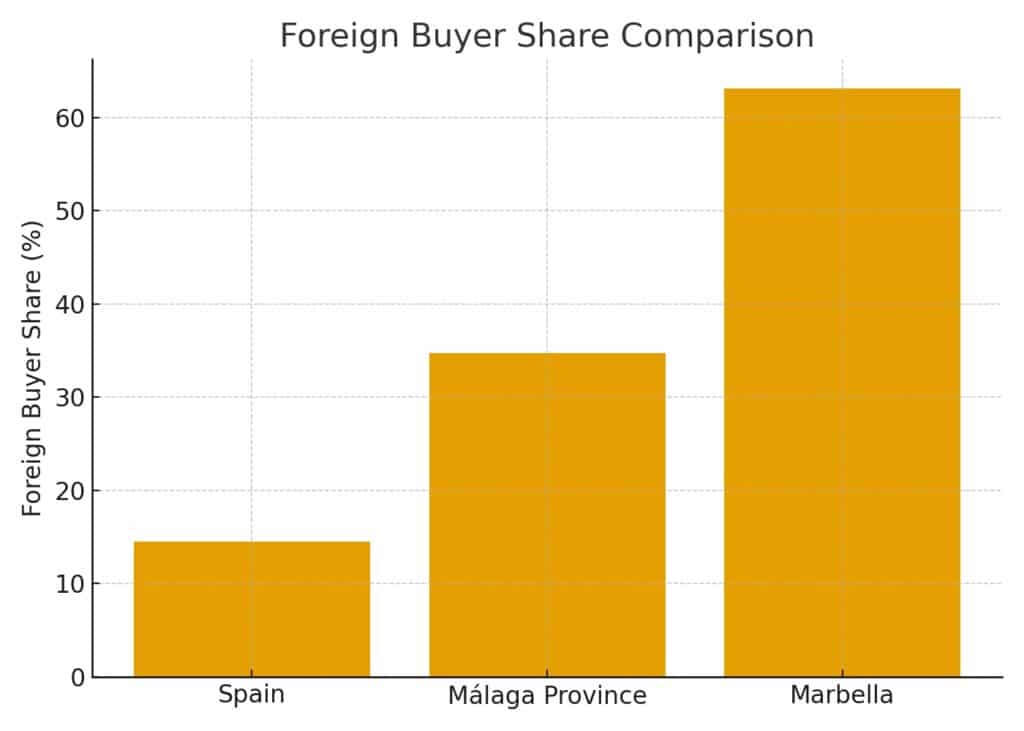

Marbella remains one of the most international markets in Europe as 2025 comes to a close. 63.14% of buyers are foreign. The average buyer age is 52 and 54% of all buyers fall between 41–60 years old. The average property size purchased is 168 m², significantly above the national average of 113 m².

In Malaga province 34.75% of buyers are foreign which is more than double the national average. British, Dutch, and Swedish buyers remain active, supported by increasing interest from Switzerland, Belgium, the Middle East, and North America.

Long Term Rentals

Long term rents have risen sharply due to limited supply and strong demand. In 2019 an 80 m² property rented for €848 per month. By mid 2025 the same size apartment rents for around €1,600 per month, an increase of almost 89% in six years.

Prime areas such as the Golden Mile, Nueva Andalucía, and Marbella East record annual rises of around 10–11%. Surrounding towns such as Ojén, Guaro, Coín, and Manilva have seen increases of 15–20% per year because tenants are looking for more affordable options.

Short Term Rentals and Regulation

The short term rental market is now heavily regulated. Owners must comply with regional, national, and community level requirements. Malaga city currently has a 3 year pause on new tourist licences. Across the province only 49.6% of authorised tourist properties are fully registered under the new national system, rising to 65% if provisional registrations are included.

A proposed 21% VAT on short term rentals is under debate but not approved.

Visas and Tax Proposals

The Golden Visa ended in April 2025. Other residency routes remain active including the Non Lucrative Visa, Digital Nomad Visa, and permits for highly skilled professionals and entrepreneurs.

A proposed tax for non EU non resident buyers of resale properties is currently under review. New build purchases would not be affected.

Planning, Legal Clarity, and Investment

Marbella is transitioning into the new LISTA planning framework. The PGOM received provisional approval in July 2025 and final approval is expected in 2026. The POU is expected between 2026 and 2028. The objectives include clearer regulation, sustainability, more green areas, and the regularisation of older properties affected by previous planning issues.

The local economy remains strong with more than 85,000 people registered with Social Security. Marbella holds 17% of all companies in the province despite representing only 9% of the population.

Infrastructure investment continues through road improvements, mobility upgrades, and the ongoing push for the coastal train. The desalination plant now supplies almost 33% of Costa del Sol water and has doubled its capacity. Estepona’s solar powered desalination plant is also nearing completion.

Private investment is growing with more than €250 million committed to new or refurbished five star hotels, as well as increased development in international schools, healthcare, and wellness facilities.

Elliott James Outlook & Marbella Pricing Reality

The Marbella real estate market in 2025 remains stable and strong. Demand is consistent, supply is limited, and Marbella continues to attract high quality international buyers. Prime areas will continue to rise in value because the region simply does not have enough modern, high quality stock to meet global demand.

The luxury segment remains largely cash driven and therefore protected from rate changes while the mid market will continue to feel the effects of regulation and financing pressure.

Overall Marbella and the wider Golden Triangle remain among the most desirable residential locations in Europe with a positive long term outlook.

There is also a hard truth that needs addressing in Marbella. Asking prices have become unrealistic in many areas and this is being driven by a simple problem. Sellers are listing too high and many agencies do not have the confidence to tell them the truth because they want the listing. Instead of guiding the seller, they allow the seller to guide them, which is the opposite of what a professional should do. When one renovated property is listed at a strong price, neighbours copy it without any justification. This pushes asking prices higher and higher with no real market evidence. Online valuations then use these inflated asking figures as data, which creates an even bigger distortion.

A simple example shows how this gets out of control. Elliott James purchased a property for €400,000 and invested €150,000 into a full renovation. It was then listed at €850,000 because the quality and design justified it. The neighbour, who has an original property with no renovation work, then raised their asking price to €450,000 simply because they saw the €850,000 listing. Another neighbour pushed theirs to €475,000 and the cycle continues. None of these increases are based on facts. They are based on assumptions and copying.

The problem becomes worse because nobody can see the real achieved price when a property sells. If the renovated property listed at €850,000 actually sells for €800,000, only the agents and the parties involved know the truth. The neighbours still believe the sale was €850,000 and reset their expectations based on fiction. We see this even in the €5–6 million bracket where villas that finally sell in the low €4 millions still influence neighbours to believe their home is worth €6 million simply because that was the asking price.

This is why Marbella needs a regulated, professional valuation system that relies on achieved prices, not advertised ones. Agencies must start guiding sellers based on evidence and not fear losing the listing. Without accurate data and honest advice, the market absorbs distorted expectations that help nobody. A professional’s job is to provide facts, not to repeat numbers the seller wants to hear.